Death Benefits

Providing for your loved ones is a substantial benefit of being an OPERS member. This is why we ask you to identify primary and contingent beneficiaries when you first enroll and again when you retire. Clear guidance from you ensures that death benefits are paid according to your wishes.

Hidden

Active Member Death Benefits

The beneficiary of an active or vested (non-retired) member will receive one of the following death benefits:

Survivor Benefit

If you were vested, eligible to vest, or eligible to retire at the time of your death, your legal surviving spouse is entitled to a survivor benefit. Your surviving spouse will be offered Option B survivor benefits. Benefits shall be payable no earlier than the date when you would have met the requirements for a normal or early retirement. If your spouse elects to receive the survivor benefit, there will be no benefit payments to your other beneficiaries.

OR

Accumulated Contributions

If no surviving spouse benefit is to be paid at your death, a one-time lump-sum payment equal to your accumulated contributions will be distributed among your primary beneficiaries. If one or more of your primary beneficiaries are deceased, accumulated contributions will be distributed among your remaining living primary beneficiaries. Contingent beneficiaries will receive accumulated contributions only if there are no living primary beneficiaries.

Note: If you are making a purchase through the installment payment plan at the time of your death, your survivor has the option to pay the remaining balance within six months.

Retired Member Death Benefits

When you pass away as a retired member, your monthly retirement benefit may continue, change, or end, depending on the type of benefit you chose at retirement.

In addition, your primary beneficiaries will receive one or more of the following death benefits:

- $5,000 Death

Your beneficiary is entitled to a lump-sum cash payment (currently $5,000) upon your death. This death benefit is not insurance and is taxable to the beneficiary. The $5,000 Death Benefit is payable only upon the death of a retiree, but not upon the death of a joint-annuitant. - Excess Accumulated Contributions

Occasionally, upon the death of a retired member, the amount of member contributions paid into OPERS is more than the total received in monthly retirement benefits. If you chose the Maximum Retirement Benefit Option at retirement and passed away before receiving in retirement benefits the balance of contributions you paid into OPERS, the difference between your accumulated contributions and the cumulative monthly retirement benefits would be paid according to your beneficiary designation. - Final Monthly Benefit Payment

If applicable, your final monthly benefit payment may be paid according to your beneficiary designation.

Report a Death

If you are the family or beneficiary of a member who passed, please contact OPERS as soon as possible with the member’s name, Social Security number, and date of death. We will also need the contact information of any relatives and/or beneficiaries..

Once the death is reported, OPERS will review the member’s record for their instructions on beneficiary and/or survivor benefits. Before benefits can be paid, a copy of the Death Certificate may be necessary. We will contact the designated beneficiaries and provide any instructions or forms.

Taxation of Death Benefit

Death benefit not rolled over is subject to mandatory federal tax withholding and state withholding for Oklahoma residents. The current withholding amounts:

Individual or trust beneficiary

20% federal tax withholding

4.75% state tax withholding for Oklahoma residents.

Non-individual beneficiary (estate, funeral home, charity, etc.)

10% federal tax withholding

4.75% state tax withholding for Oklahoma entities

Non-resident aliens

30% federal tax withholding

You may elect to rollover a portion of the death benefit. The remainder will be subject to mandatory tax withholding as listed above.

Resources for Retirement and Beyond

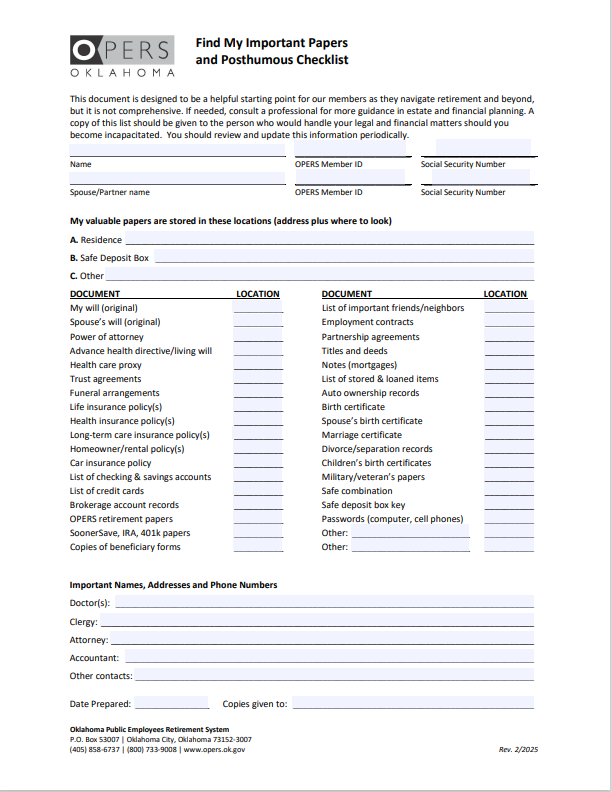

These resources are designed to be a helpful starting point for our members as they navigate planning beyond retirement, but they are not comprehensive. If needed, consult a professional for guidance in estate and financial planning.

Losing a loved one is never easy and handling financial and administrative matters during this time can feel overwhelming. To help ease the process, we’ve created a checklist outlining the key steps to take regarding OPERS benefits and other important considerations.

Keep OPERS Informed

If life events such as a marriage, birth, divorce, or death require you to change your beneficiaries, simply fill out a Beneficiary Designation Form. You also need to complete a form if your beneficiary’s name or address changes.

Your beneficiary does not change until the OPERS office receives a signed Beneficiary Designation Form. Updating your beneficiary will not change:

- Any life insurance

- SoonerSave beneficiaries

- The joint annuitant you name at retirement